Why Recessions Kill Investment Portfolios (and Poorly Protected Retirements)

Why Recessions Kill Investment Portfolios (and Poorly Protected Retirements)

We’ve all heard “You’ve got to be in it for the long term,” or “You can’t catch the rallies unless you are in the market” from brokers or financial salespeople (they prefer “financial advisor”) and as a result more than one investor has had night sweats or an obsessive compulsion to check portfolio balances several times a month when the market starts selling off hard.

But that thinking is incredibly costly:

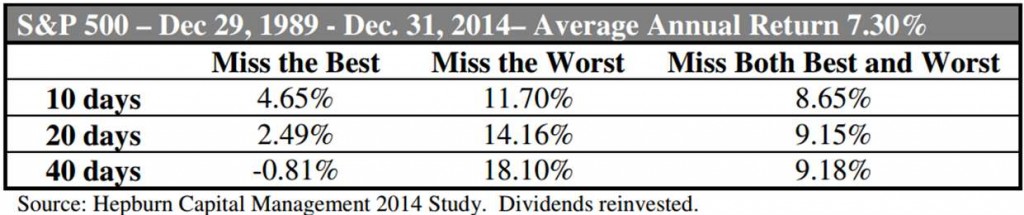

As you can see from this 25 year market study from Hepburn Capital Management, catching the rallies isn’t nearly as important as missing the valleys.

Click graphic to enlarge

If you are like most people, the above makes it pretty clear that your broker or financial salesperson (ahem, “financial advisor”) isn’t giving you the facts.

Bottom line: If you missed the best and the worst over the last 25 years, you are almost doubling your investment performance. Reasonable risk for reasonable return is good label and it’s how the most successful investors handle their accounts.

What does this really tell us?

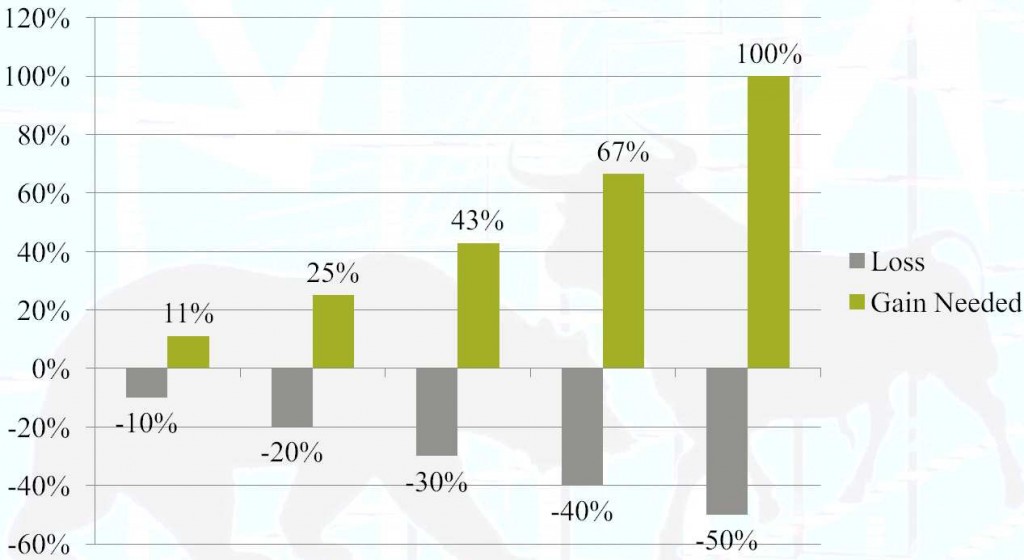

The worst times for investing are prior to recessions. Put your money to work ahead of a recession and most likely you will have to live with years of losses before your account even makes it back to break even. Why is that?

Click to enlarge

The above shows you the gain required just to get back to break even. Following the DotCom crash, it took the market about seven years just to get back to break even. Following the Great Recession, it took about five years and that was with massive, unprecedented government support in the form of trillions of quantitative easing.

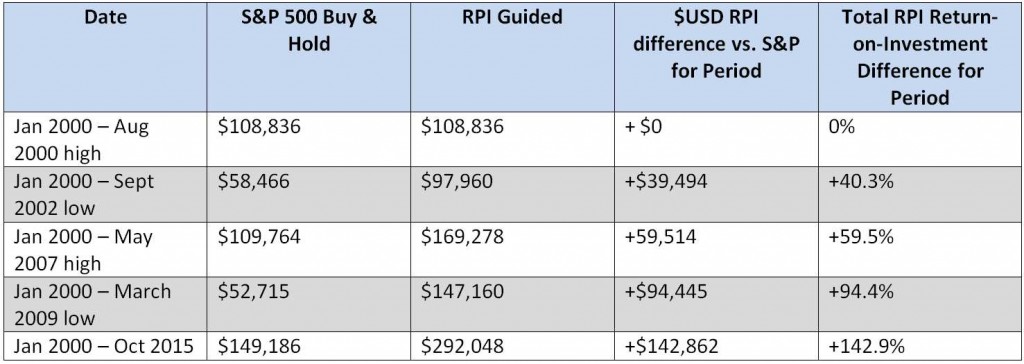

Still not buying it? Here’s an even simpler example; Pretend you had $200,000 to invest in January 2000. The first block gets invested the way financial salespeople tell you to invest – it’s going to stay invested no matter what because you “have a long term plan.”

The second block of $100,000 is, for the sake of simplicity, going to be moved to 100{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} cash as soon as it looks like a recession may be coming – Call that “RPI” guided for Recession Probability Indicator. CLICK HERE to get the most recent recession probability reading.

Click graphic to enlarge. Both examples exclude dividends.

Now, this is just an illustration, but it’s pretty clear that getting out before things get bad and getting in after things have already started to recover may be a very good thing. Consider that in this illustration, the RPI guided account would be 97{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} higher AND you didn’t have to lose sleep at night worrying if your portfolio was going to be ruined while you were “in it for the long term.“ Protecting the RPI guided account when investment conditions were not favorable made a huge difference between these two investment accounts. H-U-G-E.

The fact is, both of these accounts are in it for the long term, but normal “buy and hold” was also in it for the best days at the price of being in it for the worst days. As we’ve seen, this is too high a price to pay for most investors.

Now, your financial salesperson may have also told you that you can’t predict recessions. That is not true. The Federal Reserve, along with dozens of other in-the-know players like hedge fund and mutual fund managers, track certain sets of data to give them a heads up when a recession is coming. Nothing in life is absolutely guaranteed except death, taxes, and calls from telemarketers but these data sets – things like consumer price index, retail sales, leading indicators, purchasing managers index, etc. can be assembled to give a pretty good picture of when recessions are most likely. In the past, they have given a warning signal anywhere from three to nine months before the market realizes we’re in a recession and acts accordingly.

Click graphic to enlarge

In the above illustration, the RPI gave a recession signal in January 2008 and confirmed it in March 2008, which would have spared many investors heartache (and dollars). Is it perfect? No. The market bottomed in March 2009 and the RPI didn’t give a reinvestment signal until October 2009, seven months later. But look at the table above the graph. Even missing that seven months, the RPI guided account still saw serious and sustained gains vs. the buy and hold.

There are no guarantees the RPI will spot the next recession – in the last 30 years it’s accurately warned of a recessionary bear market a bit over 70{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} of time. Of course, there are no guarantees you will be robbed tonight – but I’ll bet your house is probably equipped with an alarm anyway.

Whatever a thief would take from your house is worth substantially less than your investment account(s). Sleep better knowing ACI is monitoring a pretty good alarm built to help protect your money.

Remember, successful investing isn’t about catching the rallies nearly as much as it is about missing the valleys.

To get a monthly update on the likelihood of recession in the form of the Recession Probability Indicator (and other good stuff), sign up at the top right.

Please Share with the buttons below.

To Smarter Investing,

Dak Hartsock

Chief Market Strategist

ACI Wealth Advisors, LLC.

Process Portfolios, LLC.