Is the S&P 500 Over Valued? Yes. What Should You Do?

Market Valuation Update November 2015

I’ve broken this update into 2 parts. The first will just give the big picture summary for my executive type clients and the second, below the illustrations, is a discussion of the factors involved for those interested.

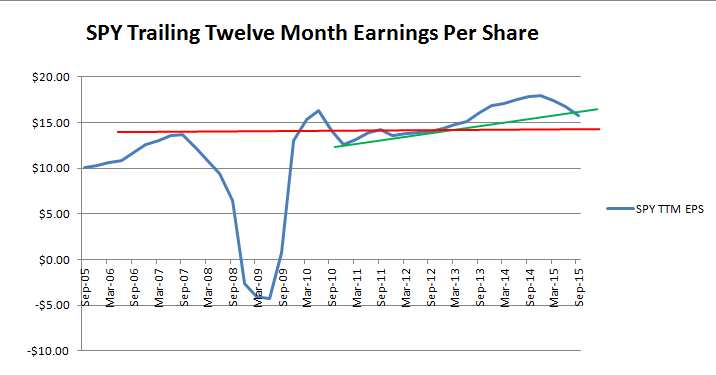

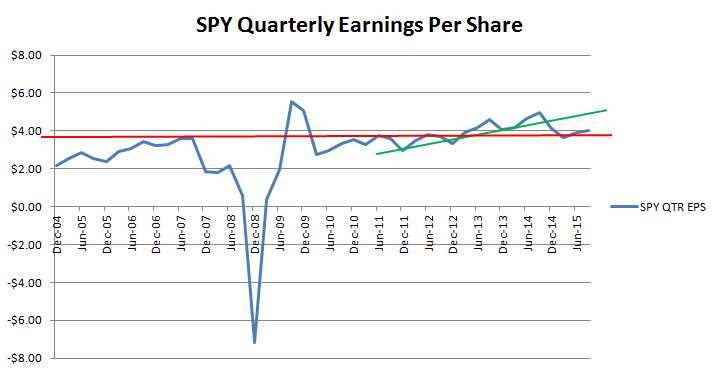

The S&P 500 earnings in the last 4 quarters have fallen about 12{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} vs. the previous 4 quarters. Price is about the same. What does this mean for investors?

Part 1 – Findings

Buying the S&P 500 Index at current prices offers total expected returns in the 1{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} – 4{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} range over the near-to-intermediate term based on current earnings. The index does not represent a good opportunity to most investors at current valuation, which is about 20{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} higher than the 10 year average value of the S&P 500.

There is about a -16{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} margin of safety associated with buying the S&P 500 at the current earnings level. In English, that means that buying the S&P index now could mean unrealized losses in the area of -16{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} for a few quarters IF earnings don’t recover. For the record, my current view is they will.

Commentary: Earnings appear to be recovering in the index and many (but not all) of the factors driving recent earnings weakness may be transitory. The American Economy is expanding, albeit slowly, while consumer spending (70{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} of the economy) is still fairly strong and appears to be increasing. Both factors should give a lift to earnings over the next few quarters, and therefore the price of the S&P 500 Index.

In the meantime, it’s probably best to seek investment opportunities away from the main stock indices, and in the US. There are solid earnings and reasonable value in several sectors including non-internet technology. Look to avoid or minimize excess exposure to assets threatened by dollar strength, Europe, South America and other less developed markets.

If you are participating in a 401k plan are unsure what to do moving into year end and next year, email me and we’ll see what can be done to put you on the best investment footing possible for 2016. —-> Contact Dak

* Negative price-to-earnings ratios during the Great Recession have been set to “0” for the graphic above to make the chart more readable, and extremely high one-time p/e’s have been capped at 25 for the same reason. Click the graphics to make them larger.

Part 2 – Discussion (optional reading)

The problem with this is not so much the reduced earnings so far in 2015 (which would be scarier if the economy was heading into recession but it isn’t), but whether historical valuations for the S&P 500 support higher prices based on current earnings. The answer to that is probably not. Earnings need to recover in order to drive the S&P meaningfully higher.

Before you panic and hit the sell button, understand that while the S&P 500 itself may not be a good investment at the moment, that doesn’t mean there aren’t good stock investments available. Most sophisticated managers look for investment opportunities beyond the S&P 500, I among them. There are solid investment opportunities out there, but right now buying the S&P 500 index probably isn’t one of them.

Why?

We saw the S&P 500 move up pretty aggressively in 2013 and 2014, but earnings began to fall as we entered 2015 due to a variety of factors I won’t get into here. The result? As earnings have fallen the valuation of the S&P 500 has risen, eroding the margin of safety in the index and also lowering expected future returns.

Because price has not followed earnings down, the S&P is a bit rich right now (about 20{1b789970f5b587cdad7e2a0d5c032cbf2e438ab9022fea5c2ba3cf7af142fa35} higher than the average 10 year valuation). This doesn’t mean it’s going to collapse, nor is the index in bubble territory. It does mean that investors are willing (so far) to pay more for less, unsurprising given alternatives in the fixed income world.

Investors continue to accept lower returns in the S&P for the simple reason that interest rates are low and basically force investors to hold risk assets. The S&P 500 in the form of the ETF SPY is one of the best known and widely owned risk assets available, which makes it the purchase of least resistance for index investors of all sizes.

To understand whether you should invest and where, it’s important to understand a few key concepts. Some clients are already familiar with these concepts. Feel free to skip.

How the Market is Priced.

The stock market is driven by valuation, and valuation is driven by earnings. This is how the wealthiest investors think, and they use that thinking to help them manage their investment risk. The term is “margin of safety” and it’s an important concept. Successful investors are searching for that margin of safety, whether they are small investors with a million or two, or a mutual fund with hundreds of billions under management. Big or small, investment success demands the same discipline.

Generally speaking, the higher the valuation versus the historical average valuation, the lower your margin of safety.

There is another side to this coin –“expected return“–it’s the potential reward you may receive for buying at a certain valuation level. The lower the valuation versus earnings, the larger the margin of safety and the larger the expected return.

Add expected return to the dividend payout and you get “total expected return” which is exactly what it sounds like.

That’s it. Hope this update helps you sort through the useless noise in the financial news.

If you have additional questions feel free to reach out, and please share using the buttons below.

Warm Regards,

Dak Hartsock

Chief Market Strategist

ACI Wealth Advisors, LLC

Process Portfolios, LLC.

Next week’s updates:

* Process Portfolios Performance Update

* Controlling Long Term Health Expenses